2024 New DOL Overtime Rules

Posted on Monday, June 24, 2024

ShareStarting July 1, 2024, the Department of Labor’s (DOL) new overtime regulations will take effect and millions of salaried employees across the United States will see an increase in their pay and again on January 1, 2025. According to the DOL’s blog, they believe this new overtime regulation will restore the promise made by the Fair Labor Standards Act (FLSA) in 1938 to protect workers in the U.S.

Who is eligible?

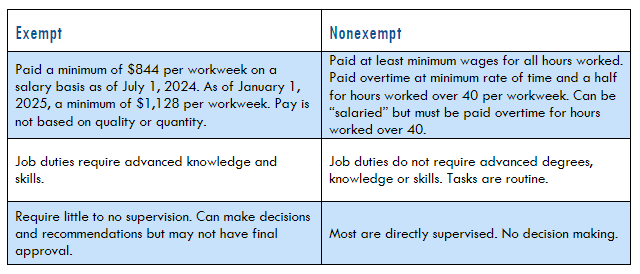

An employee’s eligibility is dependent on their classification as an exempt or nonexempt employee. The employee’s classification is not dependent on their status of part-time or full-time, their job title, or based on their pay (salary, commission, etc.). A part-time employee can be considered to have an exempt classification just as a full-time employee can be considered nonexempt.

Exempt vs. Nonexempt

Nonexempt employees are those that are not exempt from the FLSA. They are paid at least minimum wage for all hours worked and paid overtime at a rate of time and a half for any hours over 40 per workweek. The primary job duties of an exempt employee do not require any advanced degrees or knowledge and the tasks they perform are routine and directly supervised. It is important to track a nonexempt employee, even if they are paid as salary.

An exempt employee has primary job duties that require the use of advanced knowledge and skills. These employees have little or no direct supervision and have the authority to make decisions and recommendations, though they do not necessarily have final approval. Typically, they are salaried, and their pay is not based on the quality or quantity of work. Exempt employees will fall within the Executive, Administrative, Professional (EAP) exemptions, also known as white-collar exemptions or the Highly Compensated Employee (HCE) exemptions. Other exemptions they may fall under are Computer exemptions and Outside Sales exemptions.

If you are unsure how to classify your employees, the DOL provides a fact sheet to test the duties performed by your employees. DWD is also here to help!

What does this mean for employers?

As of July 1, 2024, exempt employees will be eligible for the new DOL overtime rulings. The per workweek salary increases from $684 to $844 on July 1st and then again will increase to $1,128 on January 1, 2025. Employees who are classified as exempt but do not make the minimum $844 per workweek on July 1st, will lose their exempt status. If they lose their exempt status, the employer will be required to track their hours and employees will be eligible for overtime at a rate of time and a half for any hours over 40 per workweek.

While the simplest way to avoid this reclassification would be to increase salaries, that option may not be doable for every company. So, what should employers do next? Consider the following.

- What is the current situation for your already exempt employees? If salary increases are an option, which employees need the increase July 1st and again January 1st?

- Identify potential cost implications for the company with the salary increases.

-

Do any employees need to be reclassified?

a. If so, how might the reclassification affect morale in the company? Would some view reclassification as a demotion?

b. Would reclassification cause an increase in overall overtime pay? Could work be reallocated to prevent a large increase in overtime pay?

c. If reclassified employees quit, would it be difficult to hire replacements?

- If reclassification of some employees is required, have a plan to transition the employees from exempt to nonexempt.Be up front and clear about the changes. Communication will be key! Be up front and clear about the changes. Communication will be key!

a. Be up front and clear about the changes. Communication will be key!

b. Prepare to train the effected employees on company policies like timekeeping and overtime rules.

c. If you have never had nonexempt employees, how will you record time to meet FLSA and state recordkeeping requirements?

Conclusion

As of July 1, 2024, employees who are currently salaried with an exempt status could be impacted by the new DOL overtime regulations and even more employees on January 1, 2025 when the thresholds change again. Employers should prepare for the increase in salary thresholds throughout these next several years.

As always, please reach out to DWD with questions if your company needs guidance and direction as you work through the upcoming changes.

Posted in Payroll Solutions

Disclaimer: The information contained in Dulin, Ward & DeWald’s blog is provided for general educational purposes only and should not be construed as financial or legal advice on any subject matter. Before taking any action based on this information, we strongly encourage you to consult competent legal, accounting or other professional advice about your specific situation. Questions on blog posts may be submitted to your DWD representative.